From Wikipedia, the free encyclopedia

Fractional-reserve banking is a type of banking where depositors invest base money in a bank and have the ability to earn interest, rather than having to pay the bank to hold their money. The bank takes ownership of base money entering the bank, uses it to maintain highly liquid reserves to repay expected customer withdrawals and pay for bank operations, and in return gives the customer a credit to their account, which the bank ensures the customer can use as money to buy goods and services anywhere in the economy. The bank, generally speaking, does not retain all of a particular customer’s base money deposits within the bank. Instead, the base money now owned by the bank, is constantly being used in transfers to other banks as customers spend money and the bank settles the loans it offers customers. In turn, many other banks are transferring funds via the same process to customers of the first bank. This means that base money and other liquid assets held by the bank, are only a fraction (strictly less than unity) of the quantity of customer credits at the bank. Because most bank deposits are treated as money in their own right, fractional reserve banking increases the money supply and banks are said to create money.

Bank runs (or when problems are widespread, a systemic crisis) can occur in fractional-reserve banking systems. To mitigate this risk, the governments of most countries (usually acting through the central bank) regulate and oversee commercial banks, provide deposit insurance and act as lender of last resort to commercial banks.

Fractional-reserve banking is the most common form of banking and is practiced in almost all countries. Although Islamic banking prohibits the making of profit from interest on debt, a form of fractional-reserve banking is still evident in most Islamic countries.

[edit] History

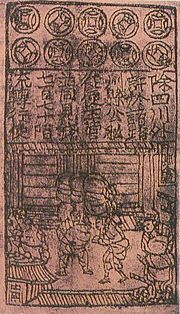

Savers looking to keep their valuables in safekeeping depositories deposited gold coins and silver coins at goldsmiths, receiving in turn a note for their deposit (see Bank of Amsterdam). Once these notes became a trusted medium of exchange an early form of paper money was born, in the form of the goldsmiths' notes.[1]

As the notes were used directly in trade, the goldsmiths observed that people would not usually redeem all their notes at the same time, and they saw the opportunity to invest their coin reserves in interest-bearing loans and bills. This generated income for the goldsmiths but left them with more notes on issue than reserves with which to pay them. A process was started that altered the role of the goldsmiths from passive guardians of bullion, charging fees for safe storage, to interest-paying and interest-earning banks. Thus fractional-reserve banking was born.

However, if creditors (note holders of gold originally deposited) lost faith in the ability of a bank to redeem (pay) their notes, many would try to redeem their notes at the same time. If in response a bank could not raise enough funds by calling in loans or selling bills, it either went into insolvency or defaulted on its notes. Such a situation is called a bank run and caused the demise of many early banks.[1]

Repeated bank failures and financial crises led to the creation of central banks – public institutions that have the authority to regulate commercial banks, impose reserve requirements, and act as lender-of-last-resort if a bank runs low on liquidity. The emergence of central banks mitigated the dangers associated with fractional reserve banking.[2][3]

From about 1991 a consensus had emerged within developed economies about the optimum design of monetary policy methods. In essence central bankers gave up attempts to directly control the amount of money in the economy and instead moved to indirect methods by targeting interest rates.[4]

[edit] Reason for existence

Fractional reserve banking allows people to invest their money, without losing the ability to use it on demand. Since most people do not need to use all their money all the time, banks lend out that money, to generate profit for themselves. Thus, banks can act as financial intermediaries — facilitating the investment of savers' funds.[2][5] Full reserve banking, on the other hand, does not allow any money in such demand deposits to be invested (since all of the money would be locked up in reserves) and less liquid investments (such as stocks, bonds and time deposits) lock up a lenders money for a time, making it unavailable for the lender to use.

According to mainstream economic theory, regulated fractional-reserve banking also benefits the economy by providing regulators with powerful tools for manipulating the money supply and interest rates, which many see as essential to a healthy economy.[6]

[edit] How it works

The nature of modern banking is such that the cash reserves at the bank available to repay demand deposits need only be a fraction of the demand deposits owed to depositors. In most legal systems, a demand deposit at a bank (e.g. a checking or savings account) is considered a loan to the bank (instead of a bailment) repayable on demand, that the bank can use to finance its investments in loans and interest bearing securities. Banks make a profit based on the difference between the interest they charge on the loans they make, and the interest they pay to their depositors. Since a bank lends out most of the money deposited, keeping only a fraction of the total as reserves, it necessarily has less money than the account balances of its depositors.

The main reason customers deposit funds at a bank is to store savings in the form of a demand claim on the bank. Depositors still have a claim to full repayment of their funds on demand even though most of the funds have already been invested by the bank in interest bearing loans and securities.[7] Holders of demand deposits can withdraw all of their deposits at any time. If all the depositors of a bank did so at the same time a bank run would occur, and the bank would likely collapse. Due to the practice of central banking, this is a rare event today, as central banks usually guarantee the deposits at commercial banks, and act as lender of last resort when there is a run on a bank. However, there have been some recent bank runs: the Northern Rock crisis of 2007 in the United Kingdom is an example. The collapse of Washington Mutual bank in September 2008, the largest bank failure in history, was preceded by a "silent run" on the bank, where depositors removed vast sums of money from the bank through electronic transfer.[citation needed] However, in these cases, the banks proved to have been insolvent at the time of the run. Thus, these bank runs merely precipitated failures that were inevitable in any case.

In the absence of crises that trigger bank runs, fractional-reserve banking usually functions smoothly because at any one time relatively few depositors will make cash withdrawals simultaneously compared to the total amount on deposit, and a cash reserve can be maintained as a buffer to deal with the normal cash demands from depositors seeking withdrawals. In addition, in a normal economic environment, cash is steadily being introduced into the economy by the central bank, and new funds are steadily being deposited into the commercial banks.

However, if a bank is experiencing a financial crisis, and net redemption demands are unusually large over a period of time, the bank will run low on cash reserves and will be forced to raise additional funds to avoid running out of reserves and defaulting on its obligations. A bank can raise funds from additional borrowings (e.g. by borrowing from the money market or using lines of credit held with other banks), or by selling assets, or by calling in short-term loans. If creditors are afraid that the bank is running out of cash or is insolvent, they have an incentive to redeem their deposits as soon as possible before other depositors access the remaining cash reserves before they do, triggering a cascading crisis that can result in a full-scale bank run.

[edit] Money creation

Main article:

money creationModern central banking allows banks to practice fractional reserve banking with inter-bank business transactions with a reduced risk of bankruptcy. The process of fractional-reserve banking expands the money supply of the economy but also increases the risk that a bank cannot meet its depositor withdrawals.[8][9] Though not a mainstream economic belief, a number of central bankers, monetary economists, and text books, have said that banks create money by 'extending credit', where banks obligate themselves to borrowers, and then later manage whatever liabilities this creates for them, where if the central bank targets interest rates, it must supply base money on demand to meet the banks reserve requirements, after the banks have begun the lending process[10][11][12][13][14][15][16][17] and that rather than deposits leading to loans, causality is reversed, and loans lead to deposits.[18][19][20][21] (Howells P, Page 33).

There are two types of money in a fractional-reserve banking system operating with a central bank:[22][23][24]

- central bank money (money created or adopted by the central bank regardless of its form (precious metals, commodity certificates, banknotes, coins, electronic money loaned to commercial banks, or anything else the central bank chooses as its form of money))

- commercial bank money (demand deposits in the commercial banking system) - sometimes referred to as chequebook money

When a deposit of central bank money is made at a commercial bank, the central bank money is removed from circulation and added to the commercial banks' reserves (it is no longer counted as part of m1 money supply). Simultaneously, an equal amount of new commercial bank money is created in the form of bank deposits. When a loan is made by the commercial bank (which keeps only a fraction of the central bank money as reserves), using the central bank money from the commercial bank's reserves, the m1 money supply expands by the size of the loan.[2] This process is called deposit multiplication.

[edit] Example of deposit multiplication

The table below displays the mainstream economics relending model of how loans are funded and how the money supply is affected. It also shows how central bank money is used to create commercial bank money from an initial deposit of $100 of central bank money. In the example, the initial deposit is lent out 10 times with a fractional-reserve rate of 20% to ultimately create $400 of commercial bank money. Each successive bank involved in this process creates new commercial bank money on a diminishing portion of the original deposit of central bank money. This is because banks only lend out a portion of the central bank money deposited, in order to fulfill reserve requirements and to ensure that they always have enough reserves on hand to meet normal transaction demands.

The relending model begins when an initial $100 deposit of central bank money is made into Bank A. Bank A takes 20 percent of it, or $20, and sets it aside as reserves, and then loans out the remaining 80 percent, or $80. At this point, the money supply actually totals $180, not $100, because the bank has loaned out $80 of the central bank money, kept $20 of central bank money in reserve (not part of the money supply), and substituted a newly created $100 IOU claim for the depositor that acts equivalently to and can be implicitly redeemed for central bank money (the depositor can transfer it to another account, write a check on it, demand his cash back, etc.). These claims by depositors on banks are termed demand deposits or commercial bank money and are simply recorded in a bank's accounts as a liability (specifically, an IOU to the depositor). From a depositor's perspective, commercial bank money is equivalent to central bank money – it is impossible to tell the two forms of money apart unless a bank run occurs (at which time everyone wants central bank money).[2]

At this point in the relending model, Bank A now only has $20 of central bank money on its books. The loan recipient is holding $80 in central bank money, but he soon spends the $80. The receiver of that $80 then deposits it into Bank B. Bank B is now in the same situation as Bank A started with, except it has a deposit of $80 of central bank money instead of $100. Similar to Bank A, Bank B sets aside 20 percent of that $80, or $16, as reserves and lends out the remaining $64, increasing money supply by $64. As the process continues, more commercial bank money is created. To simplify the table, a different bank is used for each deposit. In the real world, the money a bank lends may end up in the same bank so that it then has more money to lend out.

Table Sources:[25] | Individual Bank | Amount Deposited | Lent Out | Reserves |

|---|

| A | 100 | 80 | 20 |

| B | 80 | 64 | 16 |

| C | 64 | 51.20 | 12.80 |

| D | 51.20 | 40.96 | 10.24 |

| E | 40.96 | 32.77 | 8.19 |

| F | 32.77 | 26.21 | 6.55 |

| G | 26.21 | 20.97 | 5.24 |

| H | 20.97 | 16.78 | 4.19 |

| I | 16.78 | 13.42 | 3.36 |

| J | 13.42 | 10.74 | 2.68 |

| K | 10.74 |

|

|

|

|

| Total Reserves: |

|

|

| 89.26 |

| Total Amount of Deposits: | Total Amount Lent Out: | Total Reserves + Last Amount Deposited: |

| 457.05 | 357.05 | 100 |

The expansion of $100 of central bank money through fractional-reserve lending with a 20% reserve rate. $400 of commercial bank money is created virtually through loans.

Although no new money was physically created in addition to the initial $100 deposit, new commercial bank money is created through loans. The 2 boxes marked in red show the location of the original $100 deposit throughout the entire process. The total reserves plus the last deposit (or last loan, whichever is last) will always equal the original amount, which in this case is $100. As this process continues, more commercial bank money is created. The amounts in each step decrease towards a limit. If a graph is made showing the accumulation of deposits, one can see that the graph is curved and approaches a limit. This limit is the maximum amount of money that can be created with a given reserve rate. When the reserve rate is 20%, as in the example above, the maximum amount of total deposits that can be created is $500 and the maximum increase in the money supply is $400.

For an individual bank, the deposit is considered a liability whereas the loan it gives out and the reserves are considered assets. Deposits will always be equal to loans plus a bank's reserves, since loans and reserves are created from deposits. This is the basis for a bank's balance sheet.

Fractional reserve banking allows the money supply to expand or contract. Generally the expansion or contraction of the money supply is dictated by the balance between the rate of new loans being created and the rate of existing loans being repaid or defaulted on. The balance between these two rates can be influenced to some degree by actions of the central bank.

This table gives an outline of the makeup of money supplies worldwide. Most of the money in any given money supply consists of commercial bank money.[22] The value of commercial bank money is based on the fact that it can be exchanged freely at a bank for central bank money.[22][23]

The actual increase in the money supply through this process may be lower, as (at each step) banks may choose to hold reserves in excess of the statutory minimum, borrowers may let some funds sit idle, and some members of the public may choose to hold cash, and there also may be delays or frictions in the lending process.[26] Government regulations may also be used to limit the money creation process by preventing banks from giving out loans even though the reserve requirements have been fulfilled.[27]

[edit] Money multiplier

The expansion of $100 through fractional-reserve banking with varying reserve requirements. Each curve approaches a limit. This limit is the value that the

money multiplier calculates.

The most common mechanism used to measure this increase in the money supply is typically called the money multiplier. It calculates the maximum amount of money that an initial deposit can be expanded to with a given reserve ratio.

[edit] Formula

The money multiplier, m, is the inverse of the reserve requirement, R:[28]

Example

For example, with the reserve ratio of 20 percent, this reserve ratio, R, can also be expressed as a fraction:

So then the money multiplier, m, will be calculated as:

This number is multiplied by the initial deposit to show the maximum amount of money it can be expanded to.

The money creation process is also affected by the currency drain ratio (the propensity of the public to hold banknotes rather than deposit them with a commercial bank), and the safety reserve ratio (excess reserves beyond the legal requirement that commercial banks voluntarily hold—usually a small amount). Data for "excess" reserves and vault cash are published regularly by the Federal Reserve in the United States.[29] In practice, the actual money multiplier varies over time, and may be substantially lower than the theoretical maximum.[30]

Confusingly there are many different "money multipliers", some referring to ratios of rates of change of different money measures and others referring to ratios of absolute values of money measures.

[edit] Reserve requirements

The modern mainstream view of reserve requirements is that they are intended to prevent banks from:

- generating too much money by making too many loans against the narrow money deposit base;

- having a shortage of cash when large deposits are withdrawn (although the reserve is thought to be a legal minimum, it is understood that in a crisis or bank run, reserves may be made available on a temporary basis).

In practice, some central banks do not require reserves to be held, and in some countries that do, such as the USA and the EU they are not required to be held during the day when the banks are lending, and banks can borrow from other banks at near the central bank policy rate to ensure they have the necessary amount of required reserves by the close of business. Required reserves are therefore considered by some central bankers, monetary economists and text books to only play a very small role in limiting money creation in these countries. Most commentators agree however, that they help the banks have sufficient supplies of highly liquid assets, so that the system operates in an orderly fashion and maintains public confidance. The UK for example, that does not have required reserves, does have requirements that the banks keep a certain amount of cash, and in Australia while there are no reserve requirements, there are a variety of requirements to ensure the banks have a stabilising ratio of liquid assets, such as deposits held with local banks.

In addition to reserve requirements, there are other required financial ratios that affect the amount of loans that a bank can fund. The capital requirement ratio is perhaps the most important of these other required ratios. When there are no mandatory reserve requirements, which are considered by some mainstream economists to restrict lending, the capital requirement ratio acts to prevent an infinite amount of bank lending.

[edit] Alternative views

Theories of endogenous money date to the 19th century, and were described by Joseph Schumpeter, and later the post-Keynesians.[31] Endogenous money theory states that the supply of money is credit-driven and determined endogenously by the demand for bank loans, rather than exogenously by monetary authorities.

Charles Goodhart worked for many years to encourage a different approach to money supply analysis and said the base money multiplier model was "such an incomplete way of describing the process of the determination of the stock of money that it amounts to misinstruction"[32] Ten years later he said: "Almost all those who have worked in a [central bank] believe that this view is totally mistaken; in particular, it ignores the implications of several of the crucial institutional features of a modern commercial banking system...".[33] Goodhart has characterized the money stock as a dependent endogenous variable.[34] In 1994, Mervyn King said that the causation between money and demand is a contentious issue, because although textbooks assume that money is exogenous, in the United Kingdom money is endogenous, as the Bank of England provides base money on demand and broad money is created by the banking system.[35][36][37]

Seth B. Carpenter and Selva Demiralp concluded the simple textbook base money multiplier is implausible in the United States.[38]

[edit] Money supplies around the world

Components of US money supply (currency,

M1, M2, and M3) since 1959. In January 2007, the amount of

central bank money was $750.5 billion while the amount of

commercial bank money (in the M2 supply) was $6.33 trillion. M1 is currency plus demand deposits; M2 is M1 plus time deposits, savings deposits, and some money-market funds; and M3 is M2 plus large time deposits and other forms of money. The M3 data ends in 2006 because

the federal reserve ceased reporting it.

[clarification needed]

Components of the euro money supply 1998-2007

Fractional-reserve banking determines the relationship between the amount of central bank money (currency) in the official money supply statistics and the total money supply. Most of the money in these systems is commercial bank money. Fractional reserve banking involves the issuance and creation of commercial bank money, which increases the money supply through the deposit creation multiplier. The issue of money through the banking system is a mechanism of monetary transmission, which a central bank can influence indirectly by raising or lowering interest rates (although banking regulations may also be adjusted to influence the money supply, depending on the circumstances).

[edit] Regulation

Because the nature of fractional-reserve banking involves the possibility of bank runs, central banks have been created throughout the world to address these problems.[3][39]

[edit] Central banks

Main article:

Central bankGovernment controls and bank regulations related to fractional-reserve banking have generally been used to impose restrictive requirements on note issue and deposit taking on the one hand, and to provide relief from bankruptcy and creditor claims, and/or protect creditors with government funds, when banks defaulted on the other hand. Such measures have included:

- Minimum required reserve ratios (RRRs)

- Minimum capital ratios

- Government bond deposit requirements for note issue

- 100% Marginal Reserve requirements for note issue, such as the Bank Charter Act 1844 (UK)

- Sanction on bank defaults and protection from creditors for many months or even years, and

- Central bank support for distressed banks, and government guarantee funds for notes and deposits, both to counteract bank runs and to protect bank creditors.

[edit] Liquidity and capital management for a bank

To avoid defaulting on its obligations, the bank must maintain a minimal reserve ratio that it fixes in accordance with, notably, regulations and its liabilities. In practice this means that the bank sets a reserve ratio target and responds when the actual ratio falls below the target. Such response can be, for instance:

- Selling or redeeming other assets, or securitization of illiquid assets,

- Restricting investment in new loans,

- Borrowing funds (whether repayable on demand or at a fixed maturity),

- Issuing additional capital instruments, or

- Reducing dividends.[citation needed]

Because different funding options have different costs, and differ in reliability, banks maintain a stock of low cost and reliable sources of liquidity such as:

- Demand deposits with other banks

- High quality marketable debt securities

- Committed lines of credit with other banks[citation needed]

As with reserves, other sources of liquidity are managed with targets.

The ability of the bank to borrow money reliably and economically is crucial, which is why confidence in the bank's creditworthiness is important to its liquidity. This means that the bank needs to maintain adequate capitalisation and to effectively control its exposures to risk in order to continue its operations. If creditors doubt the bank's assets are worth more than its liabilities, all demand creditors have an incentive to demand payment immediately, a situation known as a run on the bank.[citation needed]

Contemporary bank management methods for liquidity are based on maturity analysis of all the bank's assets and liabilities (off balance sheet exposures may also be included). Assets and liabilities are put into residual contractual maturity buckets such as 'on demand', 'less than 1 month', '2–3 months' etc. These residual contractual maturities may be adjusted to account for expected counter party behaviour such as early loan repayments due to borrowers refinancing and expected renewals of term deposits to give forecast cash flows. This analysis highlights any large future net outflows of cash and enables the bank to respond before they occur. Scenario analysis may also be conducted, depicting scenarios including stress scenarios such as a bank-specific crisis.[citation needed]

[edit] Risk and prudential regulation

In a fractional-reserve banking system, in the event of a bank run, the demand depositors and note holders would attempt to withdraw more money than the bank has in reserves, causing the bank to suffer a liquidity crisis and, ultimately, to perhaps default. In the event of a default, the bank would need to liquidate assets and the creditors of the bank would suffer a loss if the proceeds were insufficient to pay its liabilities. Since public deposits are payable on demand, liquidation may require selling assets quickly and potentially in large enough quantities to affect the price of those assets. An otherwise solvent bank (whose assets are worth more than its liabilities) may be made insolvent by a bank run. This problem potentially exists for any corporation with debt or liabilities, but is more critical for banks as they rely upon public deposits (which may be redeemable upon demand).

Although an initial analysis of a bank run and default points to the bank's inability to liquidate or sell assets (i.e. because the fraction of assets not held in the form of liquid reserves are held in less liquid investments such as loans), a more full analysis indicates that depositors will cause a bank run only when they have a genuine fear of loss of capital, and that banks with a strong risk adjusted capital ratio should be able to liquidate assets and obtain other sources of finance to avoid default[citation needed]. For this reason, fractional-reserve banks have every reason to maintain their liquidity, even at the cost of selling assets at heavy discounts and obtaining finance at high cost, during a bank run (to avoid a total loss for the contributors of the bank's capital, the shareholders)[citation needed].

Many governments have enforced or established deposit insurance systems in order to protect depositors from the event of bank defaults and to help maintain public confidence in the fractional-reserve system.

Responses to the problem of financial risk described above include:

- Proponents of prudential regulation, such as minimum capital ratios, minimum reserve ratios, central bank or other regulatory supervision, and compulsory note and deposit insurance, (see Controls on Fractional-Reserve Banking below);

- Proponents of free banking, who believe that banking should be open to free entry and competition, and that the self-interest of debtors, creditors and shareholders should result in effective risk management; and,

- Withdrawal restrictions: some bank accounts may place a limit on daily cash withdrawals and may require a notice period for very large withdrawals. Banking laws in some countries may allow restrictions to be placed on withdrawals under certain circumstances, although these restrictions may rarely, if ever, be used;

- Opponents of fractional reserve banking who insist that notes and demand deposits be 100% reserved.

[edit] Example of a bank balance sheet and financial ratios

An example of fractional reserve banking, and the calculation of the reserve ratio is shown in the balance sheet below:

| Example 2: ANZ National Bank Limited Balance Sheet as at 30 September 2007[citation needed] |

|---|

| ASSETS | NZ$m | LIABILITIES | NZ$m |

| Cash | 201 | Demand Deposits | 25482 |

| Balance with Central Bank | 2809 | Term Deposits and other borrowings | 35231 |

| Other Liquid Assets | 1797 | Due to Other Financial Institutions | 3170 |

| Due from other Financial Institutions | 3563 | Derivative financial instruments | 4924 |

| Trading Securities | 1887 | Payables and other liabilities | 1351 |

| Derivative financial instruments | 4771 | Provisions | 165 |

| Available for sale assets | 48 | Bonds and Notes | 14607 |

| Net loans and advances | 87878 | Related Party Funding | 2775 |

| Shares in controlled entities | 206 | [subordinated] Loan Capital | 2062 |

| Current Tax Assets | 112 | Total Liabilities | 99084 |

| Other assets | 1045 | Share Capital | 5943 |

| Deferred Tax Assets | 11 | [revaluation] Reserves | 83 |

| Premises and Equipment | 232 | Retained profits | 2667 |

| Goodwill and other intangibles | 3297 | Total Equity | 8703 |

| Total Assets | 107787 | Total Liabilities plus Net Worth | 107787 |

In this example the cash reserves held by the bank is $3010m ($201m currency + $2809m held at central bank) and the demand liabilities of the bank are $25482m, for a cash reserve ratio of 11.81%.

[edit] Other financial ratios

The key financial ratio used to analyze fractional-reserve banks is the cash reserve ratio, which is the ratio of cash reserves to demand deposits. However, other important financial ratios are also used to analyze the bank's liquidity, financial strength, profitability etc.

For example the ANZ National Bank Limited balance sheet above gives the following financial ratios:

- The cash reserve ratio is $3010m/$25482m, i.e. 11.81%.

- The liquid assets reserve ratio is ($201m+$2809m+$1797m)/$25482m, i.e. 18.86%.

- The equity capital ratio is $8703m/107787m, i.e. 8.07%.

- The tangible equity ratio is ($8703m-$3297m)/107787m, i.e. 5.02%

- The total capital ratio is ($8703m+$2062m)/$107787m, i.e. 9.99%.

It is very important how the term 'reserves' is defined for calculating the reserve ratio, as different definitions give different results. Other important financial ratios may require analysis of disclosures in other parts of the bank's financial statements. In particular, for liquidity risk, disclosures are incorporated into a note to the financial statements that provides maturity analysis of the bank's assets and liabilities and an explanation of how the bank manages its liquidity.

[edit] How the example bank manages its liquidity

The ANZ National Bank Limited explains its methods as:[citation needed]

Liquidity risk is the risk that the Banking Group will encounter difficulties in meeting commitments associated with its financial liabilities, e.g. overnight deposits, current accounts, and maturing deposits; and future commitments e.g. loan draw-downs and guarantees. The Banking Group manages its exposure to liquidity risk by maintaining sufficient liquid funds to meet its commitments based on historical and forecast cash flow requirements.

The following maturity analysis of assets and liabilities has been prepared on the basis of the remaining period to contractual maturity as at the balance date. The majority of longer term loans and advances are housing loans, which are likely to be repaid earlier than their contractual terms. Deposits include substantial customer deposits that are repayable on demand. However, historical experience has shown such balances provide a stable source of long term funding for the Banking Group. When managing liquidity risks, the Banking Group adjusts this contractual profile for expected customer behaviour.

| Example 2: ANZ National Bank Limited Maturity Analysis of Assets and Liabilities as at 30 September 2007[citation needed] |

|---|

| | Total carrying value | Less than 3 months | 3–12 months | 1–5 years | Beyond 5 years | No Specified Maturity |

| Assets | | | | | | |

| Liquid Assets | 4807 | 4807 | | | | |

| Due from other financial institutions | 3563 | 2650 | 440 | 187 | 286 | |

| Derivative Financial Instruments | 4711 | | | | | 4711 |

| Assets available for sale | 48 | 33 | 1 | 13 | | 1 |

| Net loans and advances | 87878 | 9276 | 9906 | 24142 | 44905 |

| Other Assets | 4903 | 970 | 179 | | | 3754 |

| Total Assets | 107787 | 18394 | 10922 | 25013 | 45343 | 8115 |

| Liabilities | | | | | | |

| Due to other financial institutions | 3170 | 2356 | 405 | 32 | 377 | |

| Deposits and other borrowings | 70030 | 53059 | 14726 | 2245 | | |

| Derivative financial instruments | 4932 | | | | | 4932 |

| Other liabilities | 1516 | 1315 | 96 | 32 | 60 | 13 |

| Bonds and notes | 14607 | 672 | 4341 | 9594 | | |

| Related party funding | 2275 | 2275 | | | | |

| Loan capital | 2062 | | 100 | 1653 | 309 | |

| Total liabilities | 99084 | 60177 | 19668 | 13556 | 746 | 4937 |

| Net liquidity gap | 8703 | (41783) | (8746) | 11457 | 44597 | 3178 |

| Net liquidity gap - cumulative | 8703 | (41783) | (50529) | (39072) | 5525 | 8703 |

[edit] Criticism

The primary criticisms relate to the potential fragility of bank liquidity in a fractional reserve banking environment, the financial risk of bank runs that depositors bear when depositing money with banks, and the impact that demand deposits have on the stock of money, and on inflation (that is, the implicit expansion of the money supply and its associated impact on prices and the exchange rate). An alternative to fractional reserve banking is full-reserve banking.[40] With full-reserve banking, some monetary reformers, such as Stephen Zarlenga of the American Monetary Institute, support the concurrent issuance of debt-free fiat currency from the Treasury, while others such as Congressman Ron Paul and some economists from the Austrian school, call for a commodity currency as existed under the gold standard.[41][42][43]

[edit] Exacerbation of the business cycle

Adherents of the non-mainstream Austrian School claim that fractional-reserve banking, by expanding the money supply, will lower the interest rates compared to a hypothetical full-reserve banking system, although this idea has been criticized within mainstream economics.[44][45][46] Austrian adherents argue that the presumed discrepancy will affect the role of the interest rate as the price of investment capital, guiding investment decisions. One of the proponents of aspects of the business cycle theory, Friedrich von Hayek, shared in the Nobel Memorial Prize in Economic Sciences for 1974.[47] Hayek accepted that bank credit and fractional reserve banking — even if they contributed to business cycles — were necessary as "the price we pay for a speed of development exceeding" that which would otherwise be possible, and that "financial institutions have never been prohibited from holding fractional reserves."[48]

A few Austrian School economists, such as Pascal Salin, also suggest that a full-reserve banking system should not be enforced legally, and dispute Murray Rothbard's characterization of fractional-reserve banking as a simple form of recursive embezzlement, and rather advocate the abolition of central banking, and suggest that free banking replace the current system. Austrian monetary theorist George Selgin has also argued in favor of fractional reserve banking.[49]

[edit] Effects of an increased money supply

Fractional reserve banking involves the creation of money by the commercial bank system, increasing the money supply. According to the quantity theory of money, this larger money supply leads to more money 'chasing' the same amount of goods, which leads to a higher price level.[50] Austrian economists state that this expansion of the broad money supply (demand deposits and notes) caused by fractional reserve banking is a cause of price inflation.[51]

One of the most important weapons the Elite use to enslave humanity is the Hegelian Dialectic. The Hegelian Dialectic is a framework to guide our thoughts and actions to a predetermined solution. Understanding how the Elite manipulate us into their clutches is vital if we are going to be free. When you are aware of how the Elite use this Dialectic to steer societies,you have a pretty powerful tool in staying ahead of not only them but the crowd also.

One of the most important weapons the Elite use to enslave humanity is the Hegelian Dialectic. The Hegelian Dialectic is a framework to guide our thoughts and actions to a predetermined solution. Understanding how the Elite manipulate us into their clutches is vital if we are going to be free. When you are aware of how the Elite use this Dialectic to steer societies,you have a pretty powerful tool in staying ahead of not only them but the crowd also. When you see that the Elite are collectivists that seek to destroy individuality and freedom,the picture is easier to see. The proper scale is not this false left right paradigm,it is total government power or total freedom. If you are a freedom lover,it does not matter if your government is Fascist or Socialist,you lose. The synthesis of these two is that we get more power and money taken from us to fund every special interest in the world.

When you see that the Elite are collectivists that seek to destroy individuality and freedom,the picture is easier to see. The proper scale is not this false left right paradigm,it is total government power or total freedom. If you are a freedom lover,it does not matter if your government is Fascist or Socialist,you lose. The synthesis of these two is that we get more power and money taken from us to fund every special interest in the world. Take for example the 2008 financial crisis. The Elite took away a lot of the regulations that were enacted during the Great Depression to regulate banks. They lowered the lending rates,sparking a boom. Created all of these exotic/fraudulent funding vehicles. Made billions on the way up,knowing all along that this was going to blow up. They waited for the music to stop and for America and Congress to panic. They then had the balls to walk into Congress with a $700 Billion dollar ransom note and said sign it or there was going to be martial law in America. This financial coup d’etat was a carefully planned and executed operation by the Elite. All of the right pieces were in place to pull off this heist in less than a week.

Take for example the 2008 financial crisis. The Elite took away a lot of the regulations that were enacted during the Great Depression to regulate banks. They lowered the lending rates,sparking a boom. Created all of these exotic/fraudulent funding vehicles. Made billions on the way up,knowing all along that this was going to blow up. They waited for the music to stop and for America and Congress to panic. They then had the balls to walk into Congress with a $700 Billion dollar ransom note and said sign it or there was going to be martial law in America. This financial coup d’etat was a carefully planned and executed operation by the Elite. All of the right pieces were in place to pull off this heist in less than a week.